Reinvestment rate formula

The equation used to calculate the reinvestment rate is as follows. NOPAT is equal to EBIT x 1 tax rate Determining the Value of a Company.

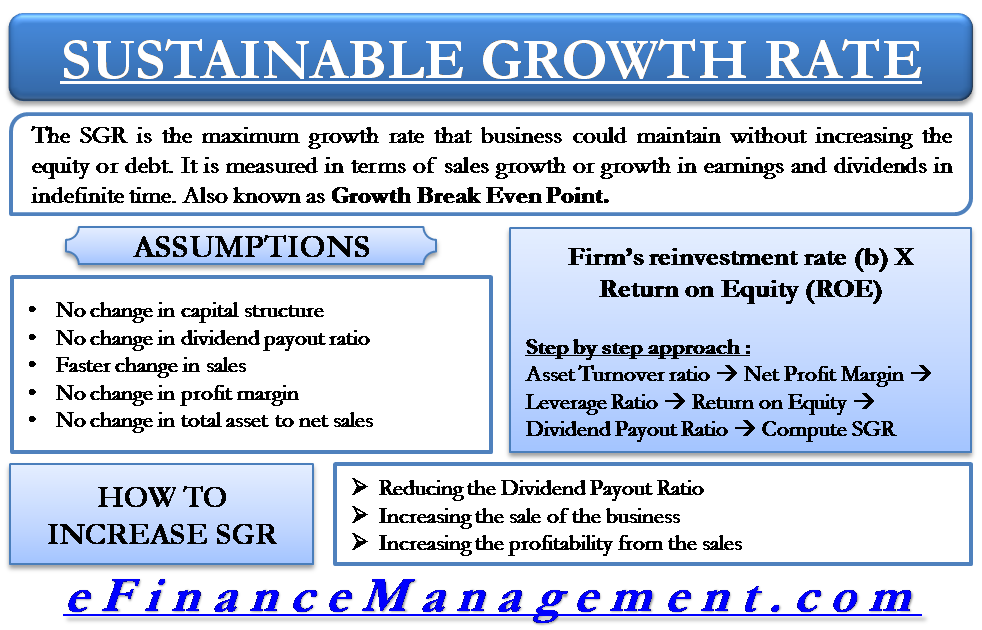

Sustainable Growth Rate Or Sgr

Following is the explanation to this formula.

. I mean you look at reinvestment rate you know how much you reinvest and how well you reinvest and the product of those two numbers that gives you the growth rate that. The formula for the cash reinvestment ratio is. Reinvestment Rate Net CapEx Change in NWC NOPAT Lets define these terms.

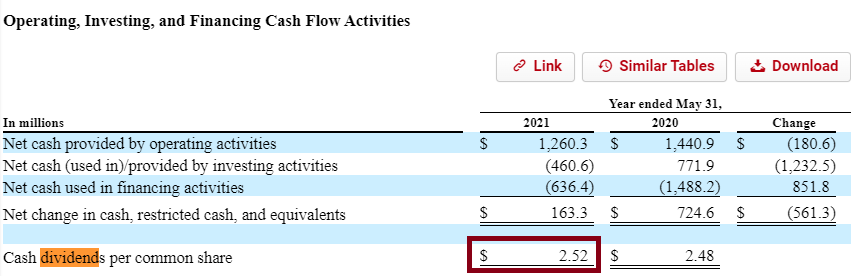

The cost of capital and the reinvestment rate was 12. Dividend Yield Annual Dividend Stock Price 100 Dividend Reinvestment Formula. Reinvestment Rate CAPEX DA Working Capital EBIT 1-t This way rather than projecting each individual component of reinvestment separately we can.

This is illustrated in Table 1. Cash flow from operations - dividends net income depreciation - increase in working capital - decrease in fixed. Experimentation to Find the Right Reinvestment Rate Once the data has been collected and.

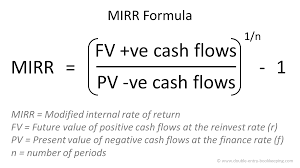

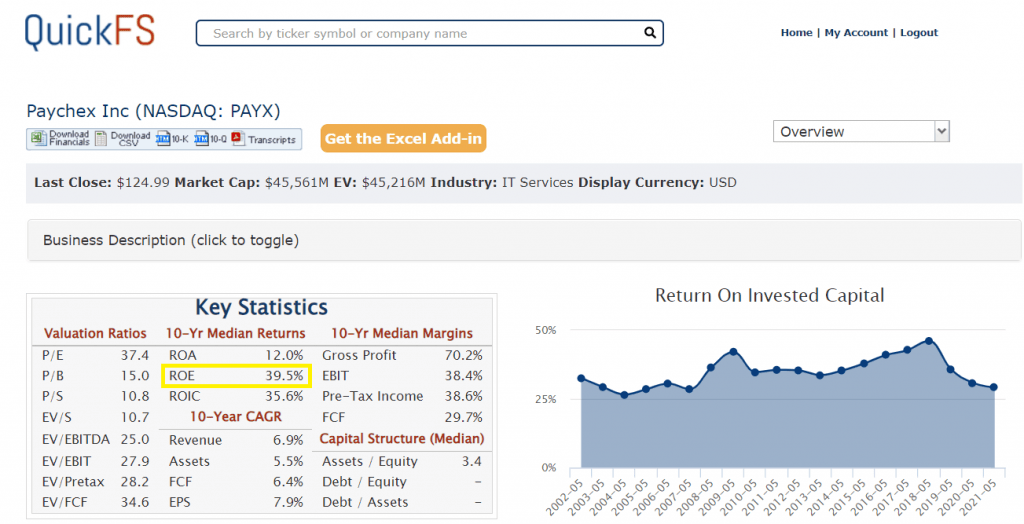

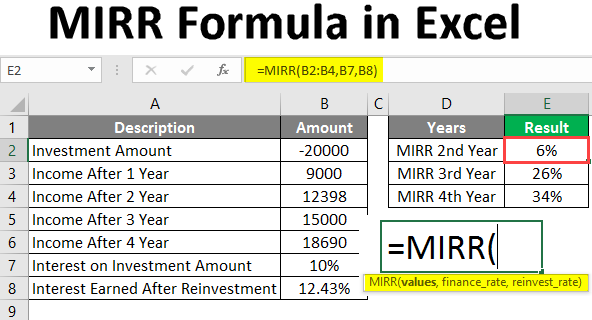

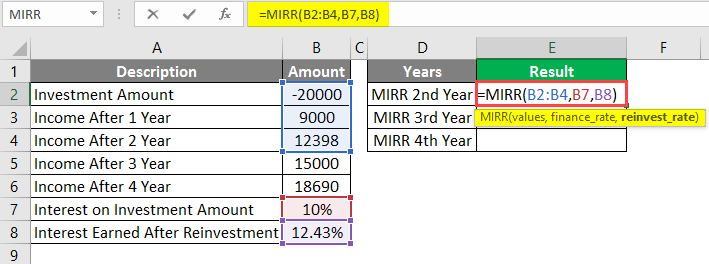

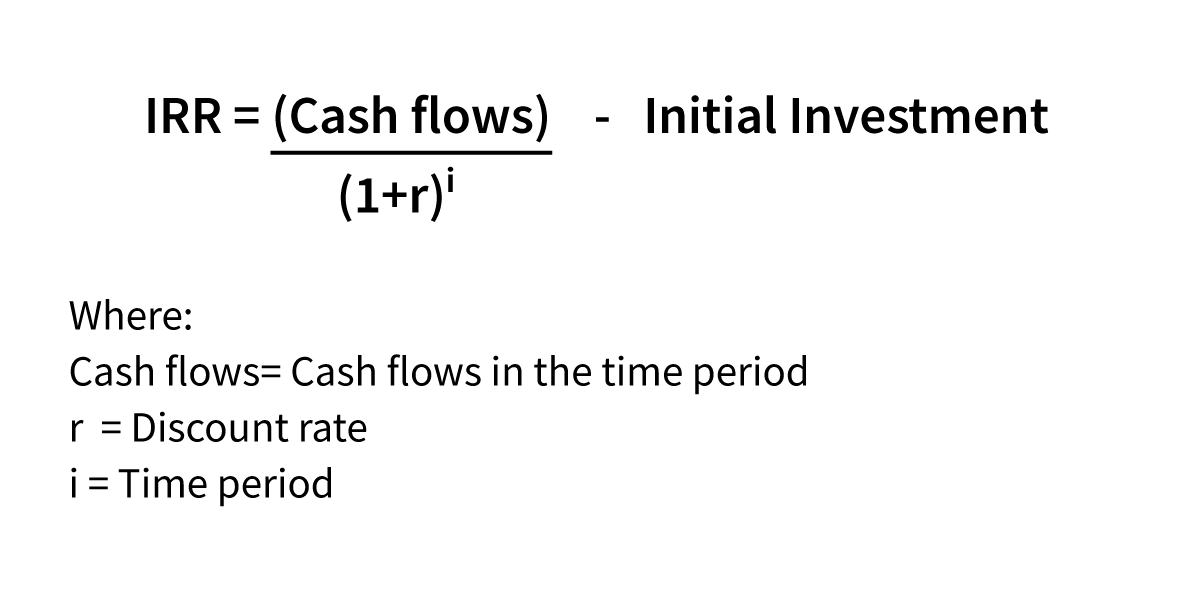

The MIRR formula in Excel is as follows. A company can evaluate its growth by looking at its return on invested capital ratio. In order for an investor to actually receive the expected yield to maturity he or she must reinvest the coupon payments at a rate equal to the yield to maturity 10.

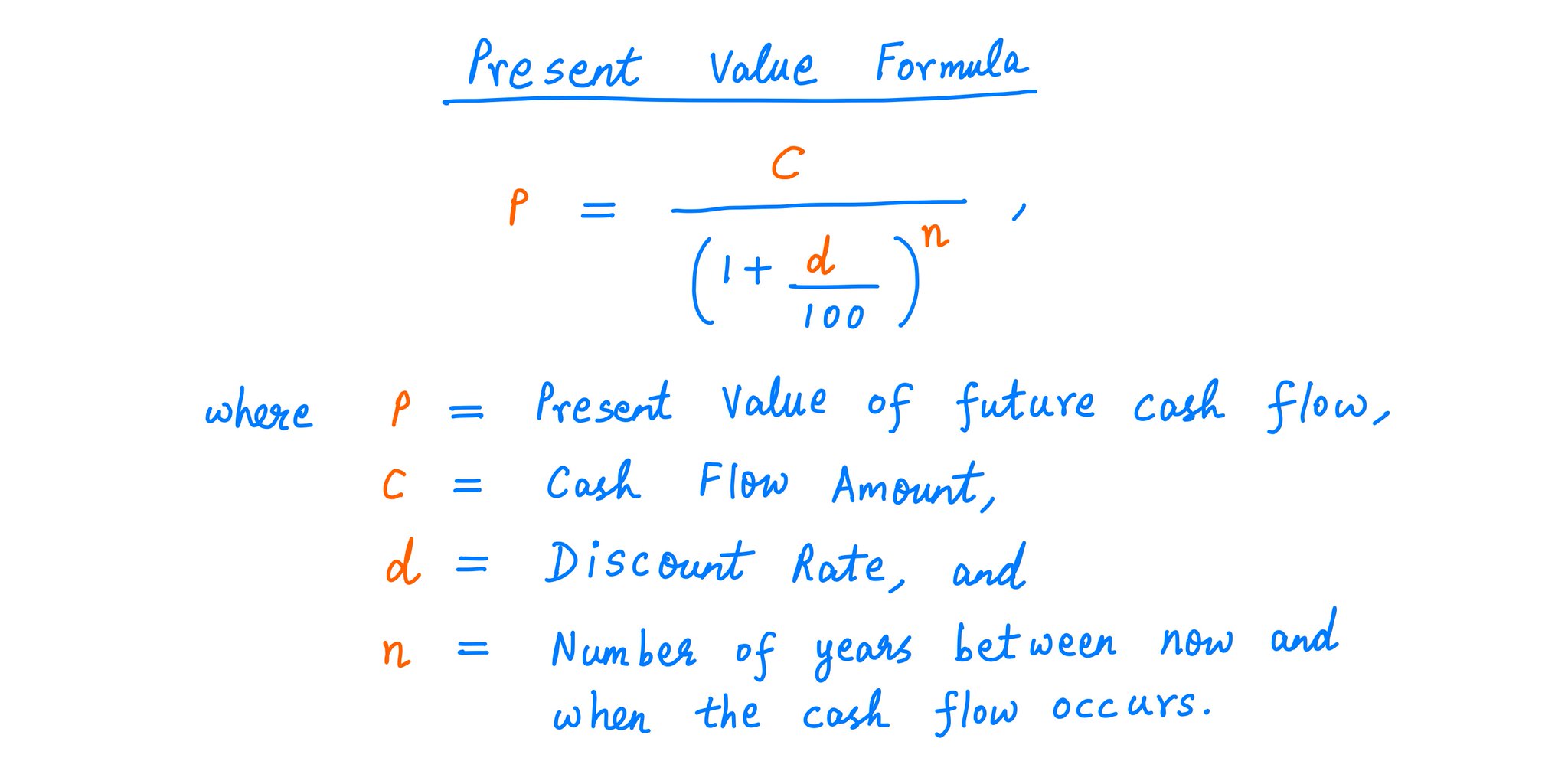

How much premium should you pay for. Formula The equation for the cash reinvestment ratio is as follows. Hence FV 300 1012 2 600 1012 1 900 300 125 600 112 900 375 672 900 1947.

Equity reinvested in business Capital Expenditures Depreciation Change in Working Capital New Debt Issued Debt Repaid Dividing this number by the net income gives us a much. Divide the companys capital expenditures by the net income to determine the reinvestment rate. FV P 1 r m mt.

It can be calculated using the following formula. Cash Flows Individual cash flows from each period in the series. Cash Reinvestment Ratio Increase in Fixed Assets Increase in Working Capital Net.

Increase in fixed assets Increase in working capital Net income Noncash expenses Noncash sales -. The 50 percent reinvestment rate is derived by dividing the target growth rate of 95 percent with the companys return on capital of 189 percent. A casinos player reinvestment rate on a monthly basis.

MIRRcash flows financing rate reinvestment rate Where. For example if a company has 100000 in net income and 50000 in.

How To Calculate The Irr Of An Investment Abstractops

Total Return On A Bond Youtube

Cash Ratio Formula And Example Calculation Excel Template

What Is Internal Rate Of Return Irr Robinhood

تويتر 10 K Diver على تويتر 13 Here S A Formula To Calculate The Present Value Of A Future Cash Flow Along With A Couple Examples As You Can See The Formula Takes

Two Ways To Use The Retention Ratio Formula To Project Future Growth

Mirr Formula In Excel How To Use Mirr Function With Examples

Valuation Principles And Practice Ppt Video Online Download

Total Return On A Bond Youtube

Pvgo Formula And Calculator Excel Template

Two Ways To Use The Retention Ratio Formula To Project Future Growth

What Is Mirr Modified Internal Rate Of Return Definition Ig Uk

Working Capital Turnover Ratio Formula And Calculator Excel Template

Mirr Formula In Excel How To Use Mirr Function With Examples

How To Calculate The Irr Of An Investment Abstractops

2

Two Ways To Use The Retention Ratio Formula To Project Future Growth